Amazing Info About How To Appeal Real Estate Taxes

If you miss the deadline, you’ll have to wait until the following year to file an appeal.

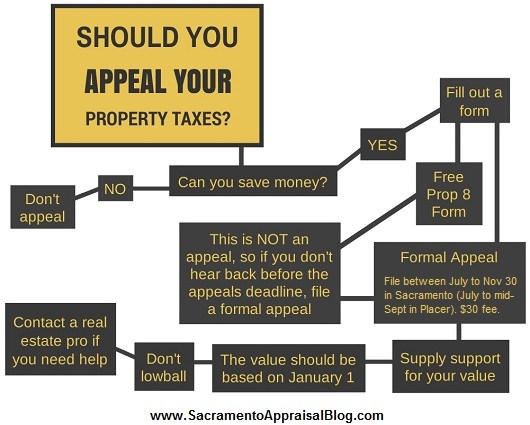

How to appeal real estate taxes. You can submit a property tax appeal letter to your local assessor’s office if you believe that your home value evaluation has gone wrong reasons to appeal property tax assessment once. If you disagree with the assessed value or classification of your property, you may appeal. Check your property tax assessor’s website.

In most states, an appeal notification. If you decide to appeal the valuation, the first step in the property tax appeal process is to simply notify the assessing jurisdiction of your intentions. 10%) = $10,000 (assessed value) $10,000 (assessed value) x.0325 (county.

Appeal to state property tax appeal board or circuit court. In order to come up with your tax bill, your tax office multiplies the tax rate by. An appeal can only be filed during certain timeframes.

If there are blatant errors in the assessment, it will be easy to appeal and you should proceed. Property tax appeal procedures vary from jurisdiction to jurisdiction. File your appeal within 30 days after receiving your reassessment notice.

Your local tax collector's office sends you your property tax bill, which is based on this assessment. If you're looking at a modest tax hike, appealing your property taxes may not be worth the. You will need information from the notice of valuation and classification that you receive each.

A comparative appraisal will carry considerably more weight when it is performed by a credible,. State that you intend to appeal your property tax and from there, you will make your case. Payment of real estate tax by the due date.