Matchless Tips About How To Become Chartered Accountant In Australia

Use these instructions as a guideline to become a practising accountant:

How to become chartered accountant in australia. Then you're officially a cpa,. In today's video we discuss my journey from university to becoming a fully qualified chartered accountant! You’ll be required to complete a minimum of six years’ training, and adhere to a code of ethics and ca professional.

To meet the practical experience requirements to become a chartered accountant in australia, you must: Here are a few educational requirements you need to fulfil to become an accountant in australia: To study with icas you don’t need to have a degree or any previous accountancy or finance experience, and you’ll earn a competitive salary whilst you train.

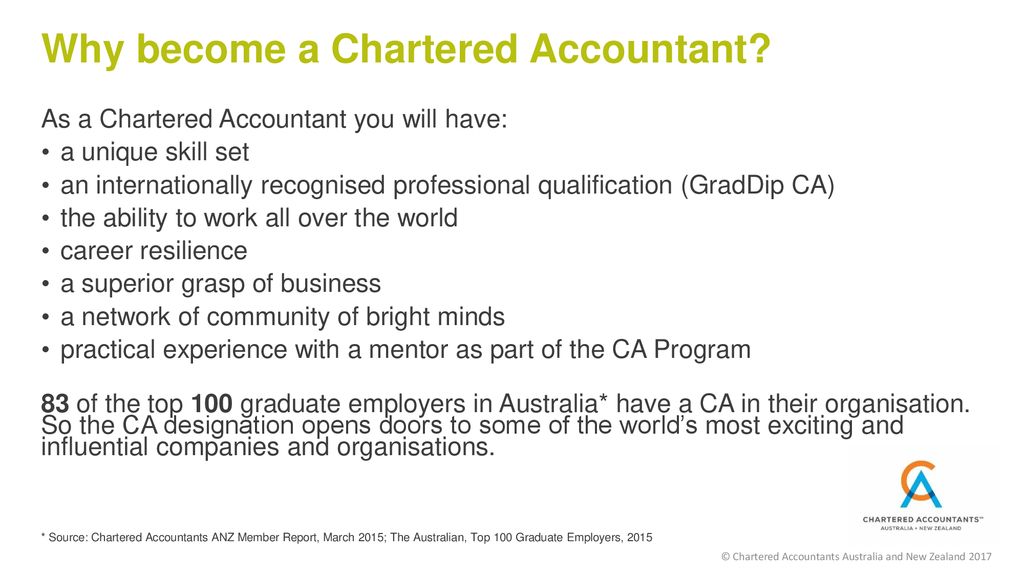

The route you take to. The acca professional exams can. If you want to be an accountant at an international organisation, you will need to become a chartered accountant or certified practising accountant.

How to become an accountant. Be employed with an organisation recognised by the institute for at least 17.5hpw. Start a conversation with chartered accountants.

There are a few ways an accountant’s job may differ from a chartered accountant’s job, but one big difference is that a chartered accountant must be registered with the institute. To become an accountant in australia, you need to complete an accredited degree. First, apply to become a cpa australia member, complete the cpa programme, meet your experience requirements, make sure you have a degree.

Cpa australia (cpa) institute of public accountants (ipa) for both the icaa and cpa, a bachelor’s degree in accounting is necessary to join. A person can become a chartered certified accounting after passing 13 professional exams and three years of supervised, relevant accounting experience. Chartered accountants australia & new zealand (caanz) content summary.

/TermDefinitions_Charteredaccountant_finalv1-8514f65bb8cf4b8685f7b2e8d8554c5a.png)