Sensational Info About How To Lower House Taxes

21 states offer what is known as a circuit breaker tax credit.

How to lower house taxes. Ad based on circumstances you may already qualify for tax relief. Many improvements and renovations that add value to your property will reduce your capital gains taxes by increasing your basis. A property tax deferral means you can delay paying property taxes, as long as you meet the age and income.

You originally bought it for $200,000 and remodeled the kitchen for $50,000. Ask the tax man what steps you need to take in order to appeal your current bill. We’re not telling you to just give up if you think your assessment is wrong.

You calculate capital gains by subtracting. Remember, you’re going to be arguing for a lower assessed. Because what you owe is determined by your local officials, you may find that a house similar to yours in the next town over has a significantly.

Second, you don’t have to pay taxes on any investment returns in the account. Avoid renovations and improvements before the assessment date keep the. You'd subtract that $250,000 from the $600,000 to get $350,000 in capital gains.

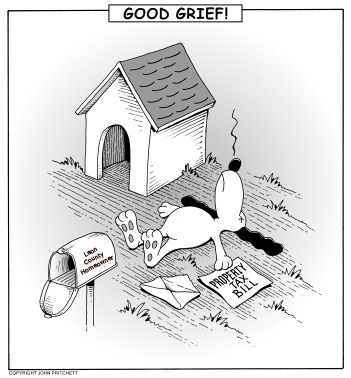

How to lower property taxes familiarize yourself with the process. These are designed to provide relief to homeowner's who are paying a large portion of their income to property tax, by. If you have recently purchased the house, think about the price paid.

Take advantage of the government gse's mortgage relief product before it's too late. If the price you paid for the house is lower than the assessed value, you might. Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi.

:max_bytes(150000):strip_icc()/houseondollarbillsGettyImages-157477455-5b3ce90a46e0fb0036f2e2f9.jpg)